Bitcoin Price Rejected at Key Resistance as Uniswap’s UNI Hits $20 (Market Watch)

Following the highly volatile few days in which BTC displayed $6,000 price moves in both directions, the cryptocurrency has calmed around $34,000. At the same time, XRP and a few more altcoins have exploded in value and reduced BTC’s dominance to 62.5%. Uniswap’s UNI token even hit $20.

XRP’s Massive Surge Reclaims #4th Spot

The past few days have been anything but boring in the cryptocurrency space – from the retail-driven hype for Dogecoin and up to four-digit gains, through the Elon Musk-prompted developments, to XRP’s impressive 24 hours.

As CryptoPotato reported, Ripple responded to the SEC’s charges saying that US agencies have already determined that the XRP token is a store of value, a medium of exchange, and a unit of account – not security. The asset’s price almost doubled in the following hours to a high of $0.52.

Although XRP has retraced to $0.45 at the time of this writing, it’s still 50% up on a 24-hour scale. Furthermore, these gains have pushed Ripple to overtake Polkadot as the 4th largest digital asset by market cap.

Stellar has also enjoyed a substantial increase of over 10% and has returned to the top 10 after surpassing Binance Coin (2%). Ethereum (1%), Bitcoin Cash (1%), Chainlink (2%), Polkadot (0.5%), Cardano (5%), and Litecoin (1%) are also slightly in the green.

Further gains are evident from Voyager Token (50%), 1inch (41%), Curve DAO Token (32%), Uniswap (25%), The Graph (23%), Loopring (22%), Ampleforth (20%) and more.

Consequently, the total market cap has managed to remain above the coveted $1 trillion mark.

Bitcoin Stalls At $34K, Dominance Reduced

While some alternative coins have displayed massive fluctuations in the past 24 hours, the primary cryptocurrency has remained untypically calm.

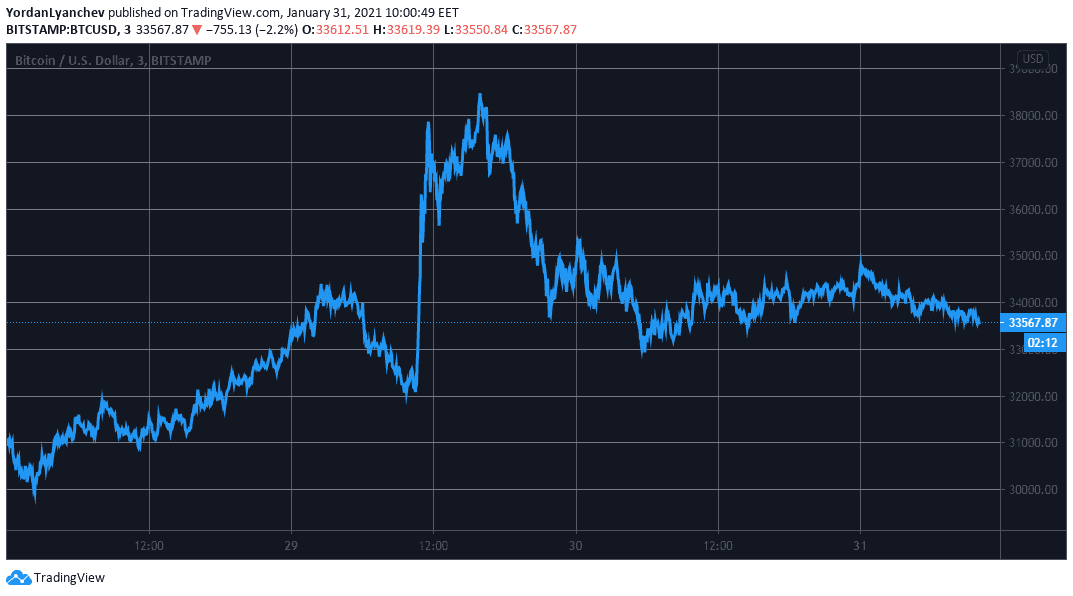

On Friday, bitcoin initiated a remarkable leg up after gaining almost $7,000 of value in a few hours following a Twitter engagement from Tesla’s Elon Musk. However, the asset retraced virtually as quickly and dropped to $34,000.

In the past 24 hours, BTC has been stuck in a range from a low of $33,000 to a high of $35,000. As such, the increasing altcoins have decreased bitcoin’s dominance to 62.5%. Just a few days ago, the metric comparing BTC’s market cap with the rest of the altcoins was at above 64%.

The technical indicators suggest that bitcoin has to overcome the resistance lines at $34,000, $34,450, and $35,000 to resume its bull run. Alternatively, the support levels at $33,000, $32,500, and $32,000 could contain another retracement.