Bitcoin Price Analysis July 24

This is a quote from our recent price analysis, two days ago:

“This could be a major obstacle from one side, and from the other side, getting over it can gain momentum towards next target levels at the $9,000 mark. Bitcoin is still consolidating during the recent days, it looks like a significant move will take place to either direction when getting into the descending line.”

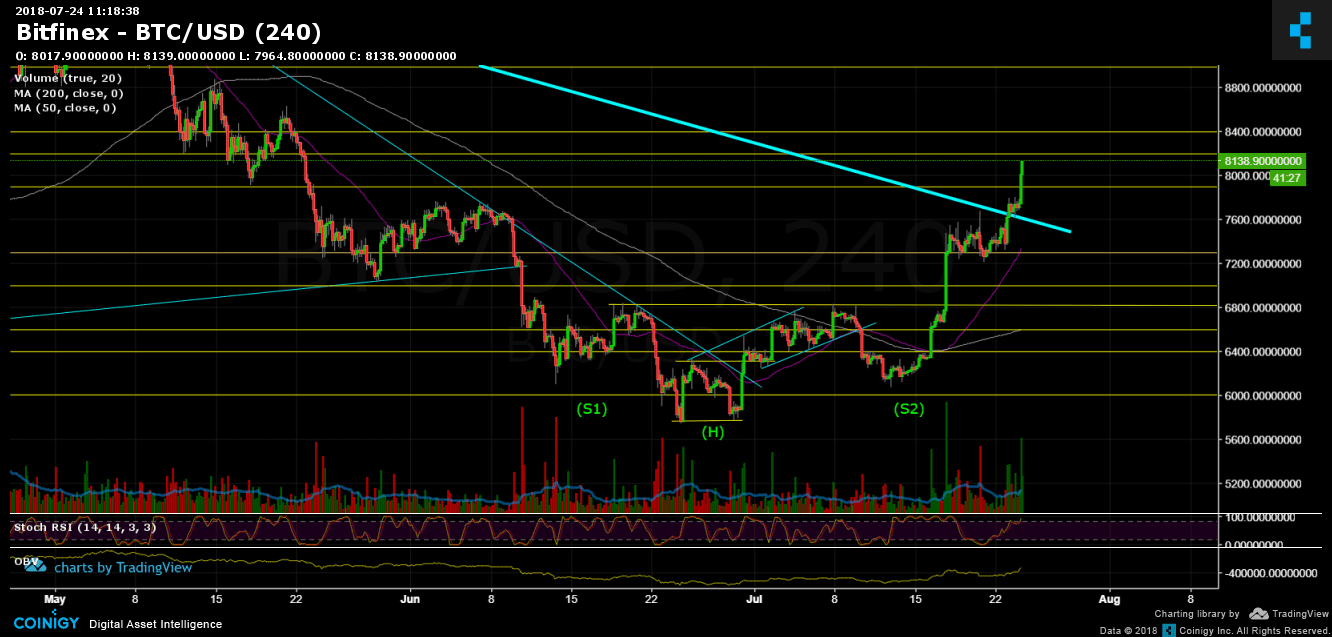

As we all may notice, Bitcoin had done a tremendous quick gain to the positive side, breaking up the long-term descending line, completing the Inverse Head and Shoulders target level at $7,800, breaking it up, and as of writing this – Bitfinex level is showing $8138 (!).

So, what now?

RSI levels are very high, the market is overbought, so we might see a correction down. The closest major support areas lie at $7,800 – $7,900. From above, $8,200 resistance level is very close by, BTC might have some difficulties breaking up those areas without a major consolidation or correction. Next resistance level is $8,400, before the major target we gave – $9,000.

Bitcoin Prices: BTC/USD BitFinex 4 Hours chart

Cryptocurrency charts by TradingView

The post Bitcoin Price Analysis July 24 appeared first on CryptoPotato.