Bitcoin Over $14,000 But Retail Hype Hasn’t Even Started

Bitcoin has been on a roll over the past few days, and it seems as if the cryptocurrency finally managed to breach the $14,000 level decisively.

What is more interesting, though, is that interest from retail investors doesn’t seem to be anywhere near its peak from back in 2017.

Bitcoin Retail Interest Nowhere to Be Seen

At the time of this writing, Bitcoin is trading at around $14,500, meaning that it’s around 37% below its historic all-time high of $20,000 charted back in December 2017.

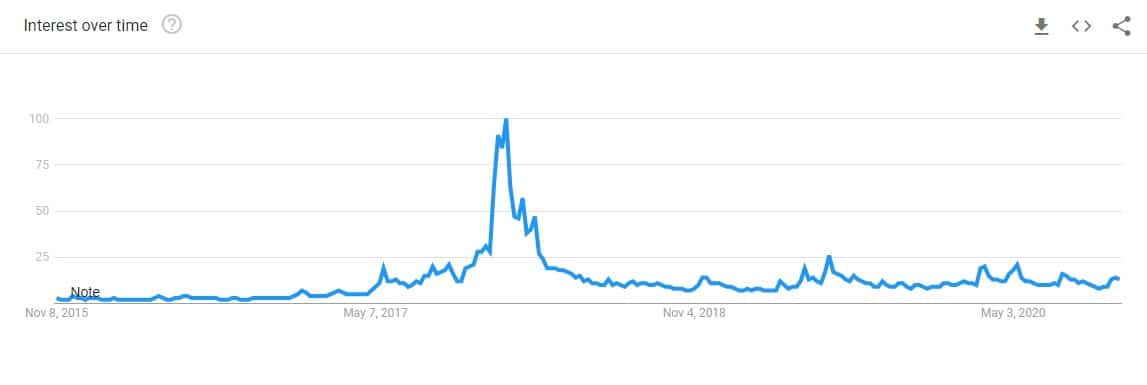

The 2017 parabolic bull run is arguably the most notable event in the cryptocurrency’s history, and it’s definitely what brought it to mainstream media and retail investors. Data from Google Trends supports this. It’s usually a good indicator of retail interest in the field.

As seen in the above chart, the current searches for the term “Bitcoin” on a worldwide scale for the past 5 years are nowhere near their peak in 2017.

So Where’s The Money Coming From?

An argument can be made that there’s a lot of new institutional investors coming to bitcoin over the past couple of months.

Right off the bat, MicroStrategy, a NASDAQ-listed public company, bought a total of $425 million worth of BTC or exactly 38,250 bitcoins. Later on, Michael Saylor, the CEO of the company, revealed that he holds 18,000 bitcoins, roughly around 0.266% of the entire supply, privately.

Jack Dorsey’s financial services company Square also purchased $50 million worth of BTC recently, joining the list of publicly-listed companies that own the cryptocurrency.

That’s not it. Reports from the beginning of the year revealed that 36% of institutional investors own Bitcoin and other cryptocurrencies. More recently, a survey showed that 26% of them also plan to increase their exposure.

In other words, at present, it does seem like the most recent rally is driven mostly by smart money. Of course, as history has shown, it’s likely that retail investors will pick up, but will it be too late by that time? We’ll have to wait and see.