Bitcoin No Longer Looks Like ‘Digital Gold’ by One Measure

Close up of Christmas lights, image from rawpixel.com / Markus Spiske.

Bitcoin No Longer Looks Like ‘Digital Gold’ by One Measure

If “digital gold” means “a safe-haven asset where investors park their money during financial market turmoil,” then bitcoin doesn’t fit the bill as well as it used to.

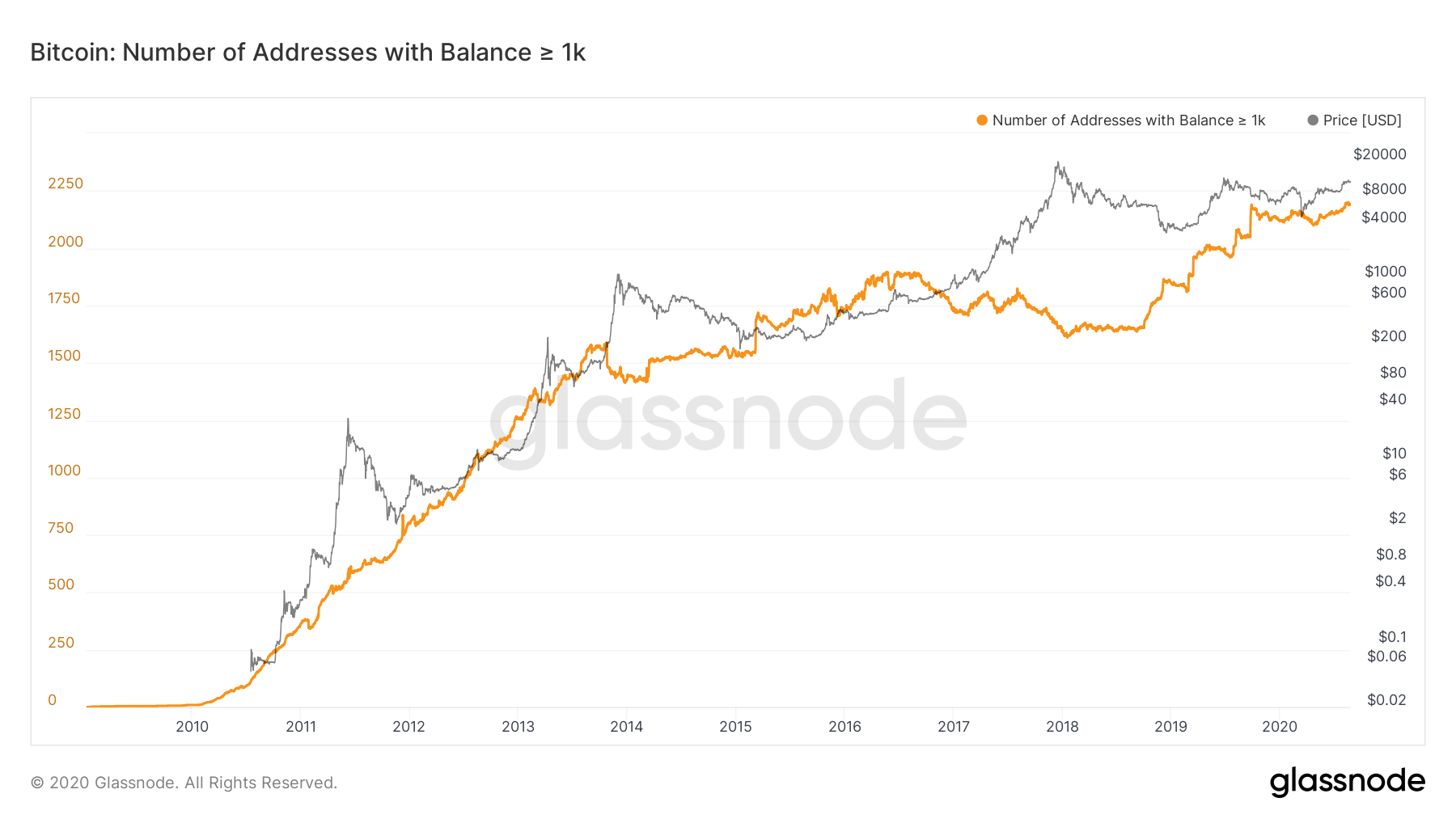

For most of the year, bitcoin’s price showed a modestly negative correlation with the S&P 500. In other words, the world’s largest cryptocurrency by market capitalization tended to rise on days when the bellwether stock-market index fell, and vice versa.

But since early October, that relationship has weakened, according to information provided by Digital Assets Data.

The correlation, once well into the negative 20-30 range, is now beginning to flatten towards a reading of around negative 10 percent, as shown in the chart below.

The closer to zero or a positive correlation with the stock market that bitcoin gets, the harder it is to paint the digital asset as a port in the storm.

“The negative correlation has supported the store of value/digital gold thesis for BTC as investors may have been moving into the asset as a hedge against global economic turmoil,” said Kevin Kaltenbacher, Data Scientist of Digital Assets Data. “These recent developments potentially present some challenges to that narrative.”

A major critic of the co-variance argument, Alex Kruger, a macro cryptocurrency analyst, took to Twitter to offer his sarcastic take, referring to both the stock and foreign exchange markets and their relationship with bitcoin.

“Now that the ‘Stocks drive bitcoin higher’ meme has been proven wrong once again, this is a good time for the ‘CNH [Chinese Yuan Offshore] hedging drives bitcoin higher’ meme to make it back to the stage,” Kruger said.

Bitcoin still up on the year

Safe haven or not, bitcoin’s price remains significantly up since the year began.

Early Wednesday UTC time, it was up 94 percent up from the price of $3,689 witnessed Jan. 1, CoinDesk’s Bitcoin Price Index shows.

At press time, the cryptocurrency is changing hands for $7,140 and is down 48.5 percent from its 2019 high at $13,880, witnessed June 26.

So even if bitcoin may not qualify as digital gold, long-term holders have nothing to fear from the price volatility bitcoin is currently experiencing, said Eddie Alfred, co-founder of Digitial Assets Data.

This period is an anomaly, he said.

“Observing 29-day periods since the genesis of bitcoin, we have seen 195 days where BTC has been down 25 percent or more from its recent high. That means the market has faced similar conditions on about 5 percent of days in BTC’s history,” Alfred said.

Disclosure: The author holds no cryptocurrency at the time of writing.

Disclaimer Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

This article is intended as a news item to inform our readers of various events and developments that affect, or that might in the future affect, the value of the cryptocurrency described above. The information contained herein is not intended to provide, and it does not provide, sufficient information to form the basis for an investment decision, and you should not rely on this information for that purpose. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments.