Bitcoin Miner Marathon First-Quarter Earnings Beat Estimates as SEC Extends Probe

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.

Marathon Digital Holdings (MARA), one of the largest publicly traded crypto miners in North America, reported a narrower-than forecast first-quarter loss per share as a rising bitcoin price and increased production helped lift the Florida-based company back toward profitability.

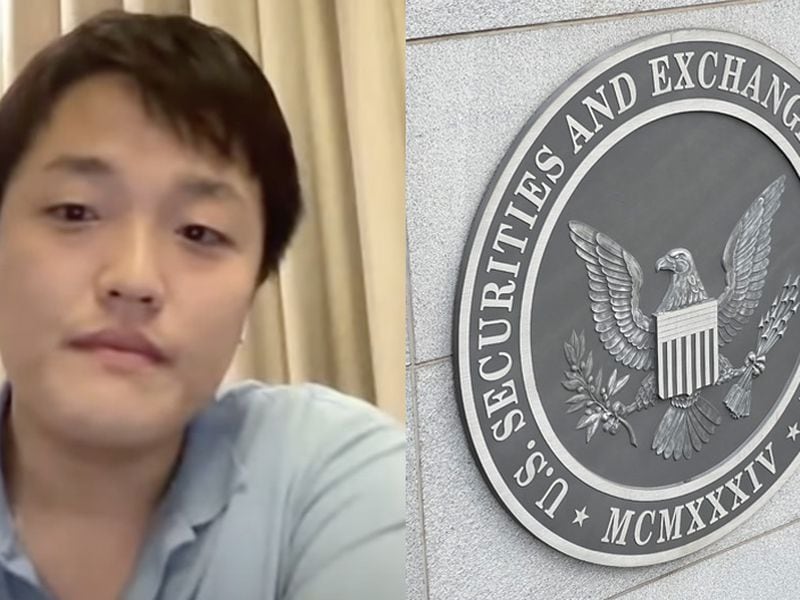

The company also said it received another subpoena from the U.S. Securities and Exchange Commission (SEC), which is looking into related-party transactions, among other things, that may have violated federal securities law. The company said it is cooperating with the investigation.

Marathon posted a net loss of $0.05 per share compared with an average estimate of $0.08 according to FactSet data. The loss narrowed from the previous quarter, when it was $3.14, as well as the same period in 2022, when it was $0.12, according to a Wednesday filing. Revenue rose to $51.1 million from $28.4 million in the previous three months. The figure was little changed from the year-earlier period. Analysts had forecast revenue of $48.8 million for the quarter.

After facing construction and operational hurdles last year, including the bankruptcy of one of its hosting partners – Compute North, Marathon has increased production. The firm’s operational hashrate increased 64% quarter on quarter to 11.5 exahash/second (EH/s) , with bitcoin production hitting a record of BTC 2,195 ($80 million) in the quarter. The price of bitcoin surged more than 70% in the first quarter.

“After weathering a tumultuous 2022 that tested the resilience of our entire industry, this year is off to a strong start as we grew our hash rate, reduced our cost to mine, and improved our balance sheet during the first quarter,” Chairman and CEO Fred Thiel said in the statement.

Marathon shares fell more than 2% in pre-market Nasdaq trading on Thursday.

The SEC subpoena follows and earlier one regarding the issuance of 6 million shares of common stock related to its Hardin, Montana facility.

The company is working on expanding its operations into the Middle East. This week, it announced a joint venture with an investment firm backed by Abu Dhabi’s sovereign wealth fund for a 200 megawatt (MW) immersion cooled facility in the emirate.

It has also worked to reduce debt levels, which were among the highest of publicly traded miners. In March, it terminated a credit facility with Silvergate Bank after earlier paying $30 million to the now-defunct bank.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.