Bitcoin Is Crashing, Indeed?

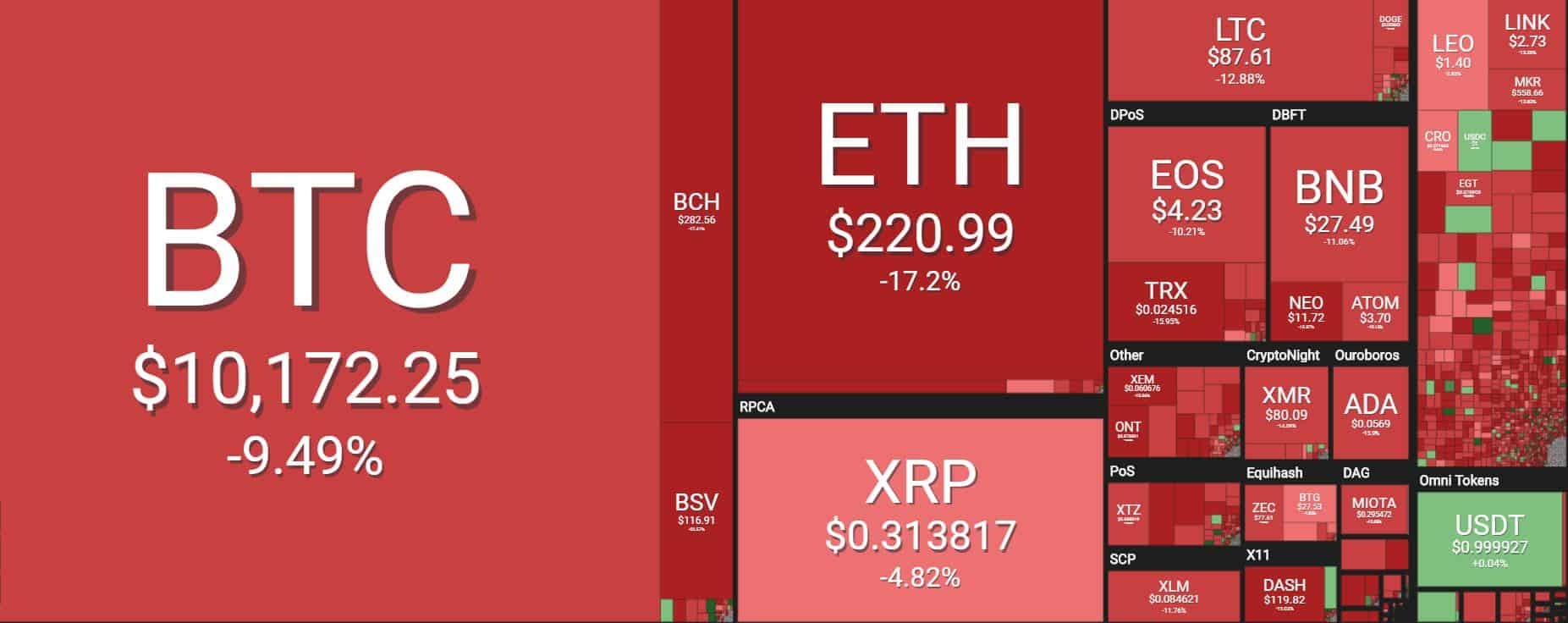

The last few days have been fairly unpleasant for Bitcoin and the entire cryptocurrency market. In the past six days, BTC surged past $13,000 only to decrease severely following that. It’s currently trading at around $10,200, which is an overall decrease of about 23%. But it’s not just Bitcoin. The entire market is trading in the red, with some large-cap altcoins such as Ethereum being down upwards of 17% in the last 24 hours alone. But how bad is this exactly?

Bitcoin Goes Down, Pulls The Market With It

It’s safe to say that we’ve seen better days of trading in the cryptocurrency market. In the past 5 days alone, Bitcoin lost more than 23% of its value and it’s currently trading at around $10,200. Naturally, the severe volatility caught the attention of the community, with a lot of people calling for a trend reversal.

At the same time, the damages were also spread across the entire market which lost around $70 billion of its total capitalization.

Many people had hoped that a correction in the price of Bitcoin would provide the suffering altcoins with a room to recover, but, unfortunately, this wasn’t the case. As Cryptopotato reported, we are apparently in a period when altcoins go down, regardless of Bitcoin’s performance.

As you can see in the above image, the altcoin market is in a very bad place right now. ETH is down more than 17%, Bitcoin Cash (BCH) as well, while others such as Bitcoin SV (BSV) are even deeper in the red with a decrease of more than 22%. Other large- and mid-cap altcoins are also marking double-digit pullbacks.

How Bad Is It Really, Though?

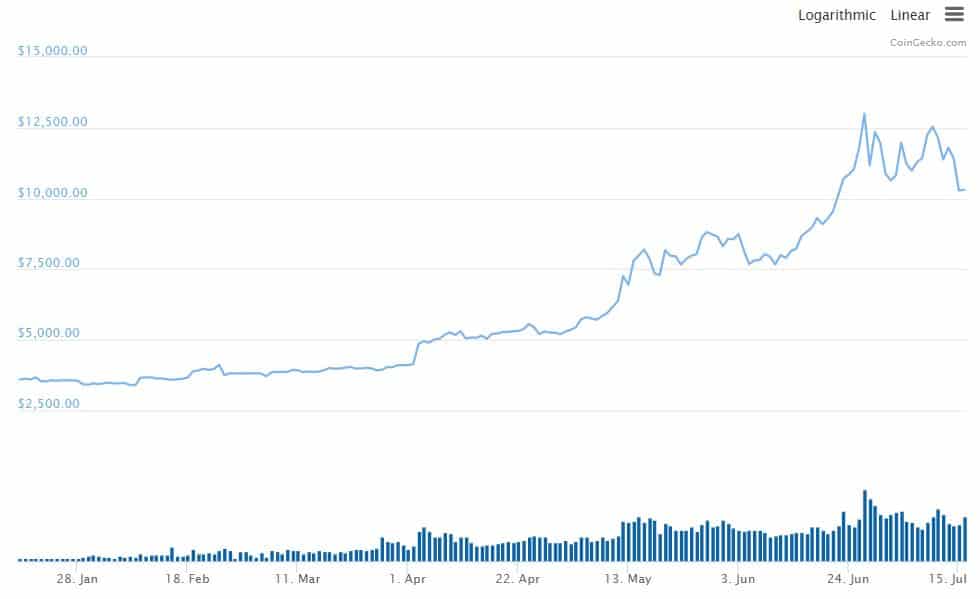

While the condition of the altcoin market is truly depressing, can we really say the same for Bitcoin? Perhaps it’s wise to take a look at the bigger picture before making rash conclusions and statements that Bitcoin is crashing.

Looking at the price of Bitcoin since the beginning of this year alone, we can clearly see the progress it has made. It started the year trading at around $3,700 and is up more than 175% year-to-date, factoring in the steep 23% decline of the past few days.

This has caused popular Bitcoin proponents and industry commentators to outline that this can hardly be caused “crashing.” The senior market analyst at eToro, Mati Greenspan, for instance, said that Bitcoin is “the only asset that consistently crashes up.”

On the other hand, this recent correction doesn’t seem to faze John McAfee as well, who holds strong with his $1 million BTC price prediction by the end of 2020.

Bitcoin is at the mid 10’s and people worry. LMFAO!! Why do you pay attention to weekly fluctuations? Look at the past few months FFS! It’s rising drastically. I’m still positive about my $1 mil BTC price by the end of 2020. Alt coins like MTC and Apollo will rise ten times more.

— John McAfee (@officialmcafee) July 14, 2019

Moreover, it’s also worth outlining that corrections of the kind could also be very healthy for the cryptocurrency’s overall future performance.

It’s also important to keep in mind that we have very serious industry events that are still to take place. For example, Bakkt, the Bitcoin futures trading platform spearheaded by the Intercontinental Exchange (ICE) is supposed to start user acceptance testing in a week’s time. What this goes to show is that Bitcoin managed to increase tremendously in 2019 and its parabolic movement wasn’t even catalyzed by industry-altering events.

In other words, while the prices have gone south lately, it’s important to keep the bigger picture in mind. And yet, in highly volatile periods as this one, it’s important to remain extra vigilant.

The post Bitcoin Is Crashing, Indeed? appeared first on CryptoPotato.