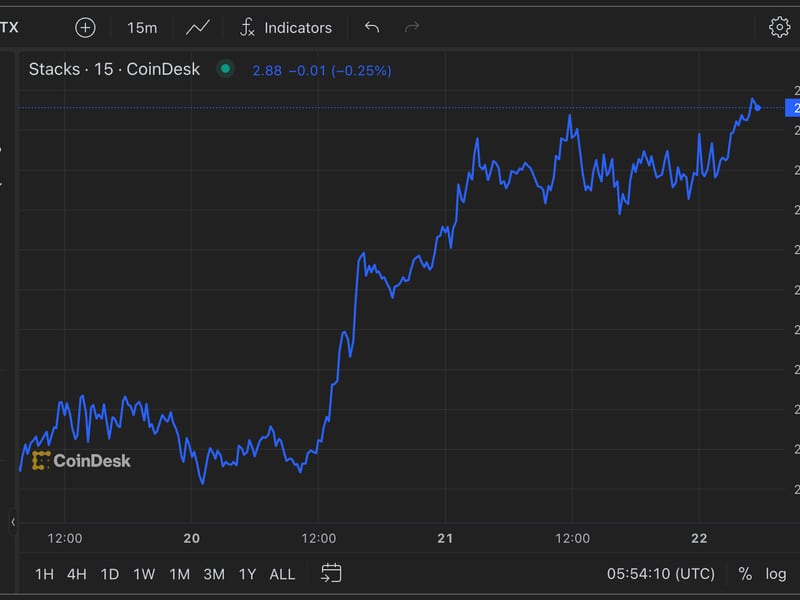

Bitcoin Eyes $12K Price After 6-Day Streak of Gains

Bitcoin’s six-day run of gains has shifted the focus to the psychological hurdle of $12,000. Some analysts are looking even higher.

- Bitcoin closed up for the sixth consecutive day on Monday, confirming its longest daily winning trend since August 2019, CoinDesk data shows.

- The cryptocurrency has rallied from $10,500 to $11,700 since last Wednesday.

- According to eToro market analyst Simon Peters, the upward move is likely to continue.

- Payment company Square’s foray into bitcoin has boosted investor confidence in the cryptocurrency’s long-term prospects and got the community wondering which other companies could potentially be next, he said.

- Technical bias, too, has turned bullish with the cryptocurrency’s convincing move above resistance at $11,250.

- Peters, however, warned that some consolidation may be seen before a move to $12,000, as the cryptocurrency looks overbought in the short-term.

- “There is every chance we could see a little dip (hopefully staying above $11,000). But the best case is for range play at current levels followed by a run to $12K in the coming days/weeks,” Peters told CoinDesk.

- Bitcoin has come under pressure in the past 12 hours, falling from $11,723 to $11,450.

- With the pullback, the hourly chart relative strength index (RSI) has fallen back into underbought (bullish) territory below 70.

- Patrick Heusser, a senior cryptocurrency trader at Zurich-based Crypto Broker AG, believes there is scope for a bigger bullish move in the near term.

- “The probability of bitcoin rising to $14,000 from current levels is stronger than the odds of a decline to $10,500,” Heusser told CoinDesk in a Twitter message.

- Supporting the bullish case is the pick up in open interest and trading volumes for futures listed on major exchanges.

- Global open positions or open interest increased to $4.3 billion on Monday – the highest level since Sept. 2, according to data source Skew.

- Open interest has risen by nearly 20% so far in October.

- Meanwhile, futures trading volume doubled to $14 billion on Monday to hit the highest level since Sept. 21.

- A rise in open interest and trading volumes alongside a rise in price is said to confirm an uptrend.

- However, upside may be capped near $12,000, as there are large sell orders placed around that level on the U.S.-based cryptocurrency exchange Coinbase and some Asian platforms, according to Heusser.