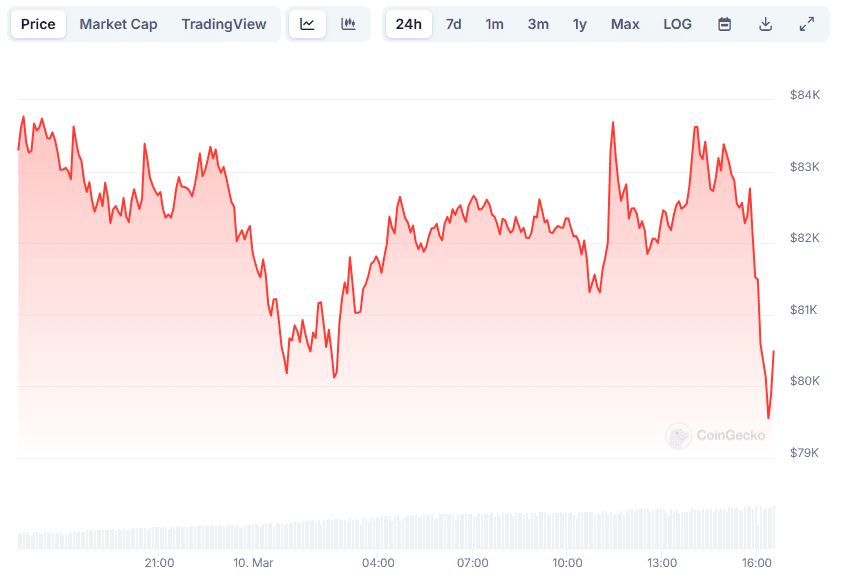

Bitcoin (BTC) Collapses Below $80K, What’s Next?

Boring days in the world of crypto have become such a rarity lately. Most leading digital assets have experienced huge volatility in the past several days, with Bitcoin (BTC) being an evident example.

Its price briefly stabilized at around $86,000 over the weekend before heading south at the start of the business week again. As CryptoPotato reported, it tumbled to approximately $80K, leaving multi-million liquidations on a 24-hour scale.

Later, the bulls stepped in and pushed the valuation to almost $84,000. The revival, though, was short-lived and was followed by another freefall to as low as $79,500.

As of this writing, BTC trades at around $79,700, which represents a 5% decline for the day. Its market capitalization has dropped below $1.6 trillion.

And while many industry participants hope this is yet another temporary pullback that could be replaced by a renewed bull run, others are not so optimistic.

BitMEX’s co-founder Arthur Hayes recently predicted that BTC could retest $78,000 (a level it last dipped to at the end of February). “If it fails, $75,000 is next in the crosshairs,” he added.

Some on-chain metrics support Hayes’ thesis. According to CryptoQuant’s data, BTC’s exchange netflow has been positive in the last two days, suggesting a shift from self-custody methods toward centralized exchanges. This, in turn, increases the immediate selling pressure.

The post Bitcoin (BTC) Collapses Below $80K, What’s Next? appeared first on CryptoPotato.