Bitcoin ‘Banana Zone’ is next if these 3 indicators play out

Bitcoin “Banana Zone” is on the horizon, but it will need to reverse these key metrics first to maintain a “sustainable recovery.”

Related Posts

Mnemonic raises $4 million to launch B2B API platform focused on NFT’s

The co-founders have previous experience working as senior executives and lead data engineers at global corporations such as Google, Uber, Reddit and Change.org, among others. 260 Total views 24 Total shares Mnemonic has emerged from a period of six-month incubation to announce the upcoming launch of its nonfungible token (NFT) analytics platform designed to facilitate…

Virgin Voyages launches ‘first cruise product to accept Bitcoin’

The new offering builds on previous seasonal passes offering a full year’s worth of voyages for a single fee.

Inflation got you down? 5 ways to accumulate crypto with little to no cost

Experienced crypto traders know that bull markets are for selling and bear markets are for accumulation, but the latter can be difficult amid a backdrop of surging inflation that saps the purchasing power of fiat currencies. As the crypto market heads deeper into crypto winter, with prices in the gutter and developers focused on creating the…

SEC delays BTC ETF decision, Grayscale triumphs SEC, and BitBoy gets the boot: Hodler’s Digest, Aug 27 – Sept 2

Keep track of Grayscale's victory over the SEC, Ben Armstrong getting the boot and delays for spot Bitcoin ETFs. by Editorial Staff 7 min September 3, 2023 Share Tweet Share Share Top Stories This Week Grayscale wins SEC lawsuit for Bitcoin ETF review Crypto asset manager Grayscale Investments recently scored a big win in its

What happens when 1% of Bitcoin holders control 99% of BTC supply?

Whales have amassed a large portion of the Bitcoin in circulation, with around 1.86% of addresses holding most of the supply.

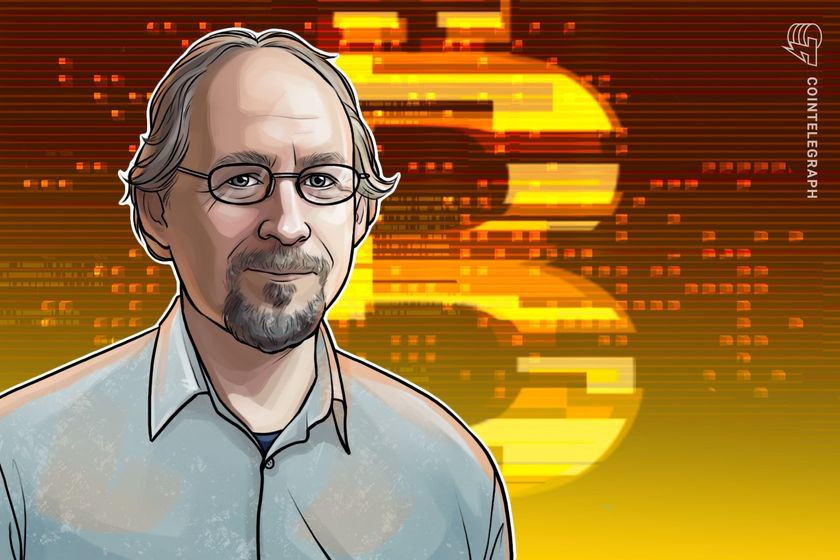

Bitcoin treasury firms driving $200T hyperbitcoinization — Adam Back

According to Back, Strategy and other Bitcoin treasury firms are some of the earliest bettors on Hyperbitcoinization, which may see Bitcoin’s market cap soar to above $200 trillion. 307 Total views 1 Total shares Investment firms with Bitcoin-focused treasuries are front-running global Bitcoin adoption, which may see the world’s first cryptocurrency soar to a $200

European Central Bank Calls for Proactive Stablecoin Regulation

The European Central Bank says global stablecoins require clear regulatory structure prior to approval. In a recent in-depth report on global stablecoins, the European Central Bank, or ECB, pushed for clear regulatory parameters for stablecoins, citing risks as well as gaps in current regulations. "In order to reap the potential benefits of global stablecoins, a robust…

NYSE Arca Files Proposed Rule Change with SEC for Bitcoin-, T-Bills-Backed Investment Trust

NYSE Arca has filed a proposed rule change with the United States Securities and Exchange Commission (SEC) for an application to list shares in a bitcoin (BTC) investment trust that would be backed by the cryptocurrency and T-bills. The development was revealed in an SEC filing published on May 20.The Chicago-headquartered exchange — a subsidiary…