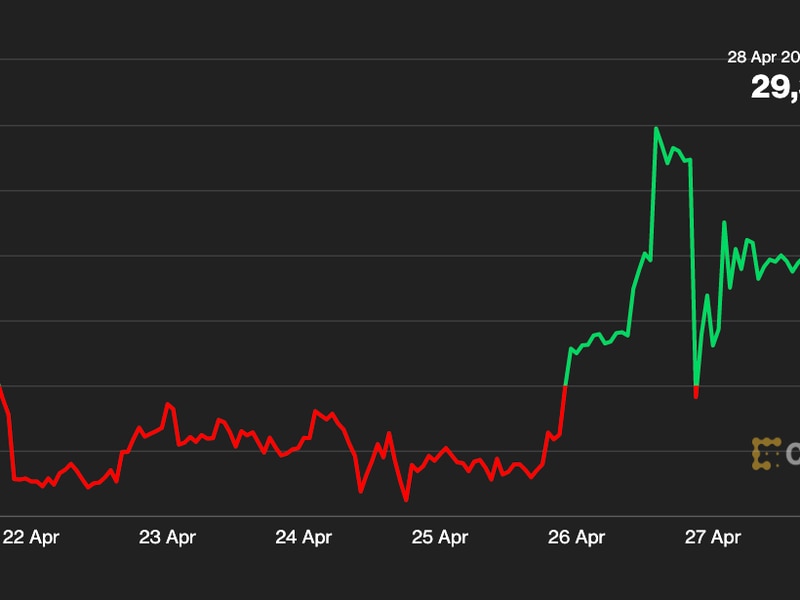

Bill Miller-Run $2.25B Fund May Buy GBTC to Gain Bitcoin Exposure of Up to 15%

The fund noted that it would not expose more than 15% of its $2.25 billion in assets to bitcoin.

Bill Miller-Run $2.25B Fund May Buy GBTC to Gain Bitcoin Exposure of Up to 15%

Miller Value Funds–run by veteran hedge fund manager and bitcoin bull Bill Miller–may invest in the Grayscale Bitcoin Trust through its flagship fund, the Miller Opportunity Trust.

“The Fund may seek investment exposure to bitcoin indirectly by investing in the Grayscale Bitcoin Trust, an entity that holds bitcoin,” the fund wrote in a filing with the U.S. Securities and Exchange Commission. “The Grayscale Bitcoin Trust invests principally in bitcoin. The Fund will not make any additional investments in the Grayscale Bitcoin Trust if, as a result of the investment, its aggregate investment in bitcoin exposure would be more than 15% of its assets at the time of investment.”

Miller Opportunity Trust had assets under management of $2.25 billion as of Dec. 31, 2020, making the fund’s potential maximum investment in GBTC $337 million.

In late January, Miller’s son, Bill Miller IV, said in a letter to investors in another Miller fund that taking part in MicroStrategy’s $650 million convertible senior note offering was like getting an almost-free call option on bitcoin.

Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.

Read more: Why Did Bill Miller and His Son Buy MicroStrategy Debt? It’s the Bitcoin