Bears In The Market – Nio Inc (NIO) Crashes 21%: Wall Street Thursday Pre-Market Summary & Analysis

The bottom line of Wednesday’s trading day is price declines of 0.52% -0.93%. The market began to fall more and more until noon this afternoon and was already down by 0.6-0.9%. In the second part of the day, there was an attempt to recover which was not successful. Toward the end of the day, the indices returned to today’s low. However, the indices had stopped on interesting support levels.

S & P dropped 0.65% to 2771, stops the daily decline on support of 2770, following breaking down the rising 2-months ascending line. “signs of slowing.” Support: 2770, 2750 (MA-200), 2710-2715 Resistance: 2800, 2815-2820, 2860.

Dow Jones dropped 0.52% to 25673, so yesterday the index had already broken a rising trend-line (shown on the following chart). Was trading around 25450-25900. Support: 25450-500, 25000-100, 24650-700 Resistance: 25850-900, 26000, 26250-300.

NASDAQ fell 0.93% to 7506, settled on support. Support: 7475-500, 7400, 7340-50. Resistance: 7550, 7600, 7650-70 .

Market Overview

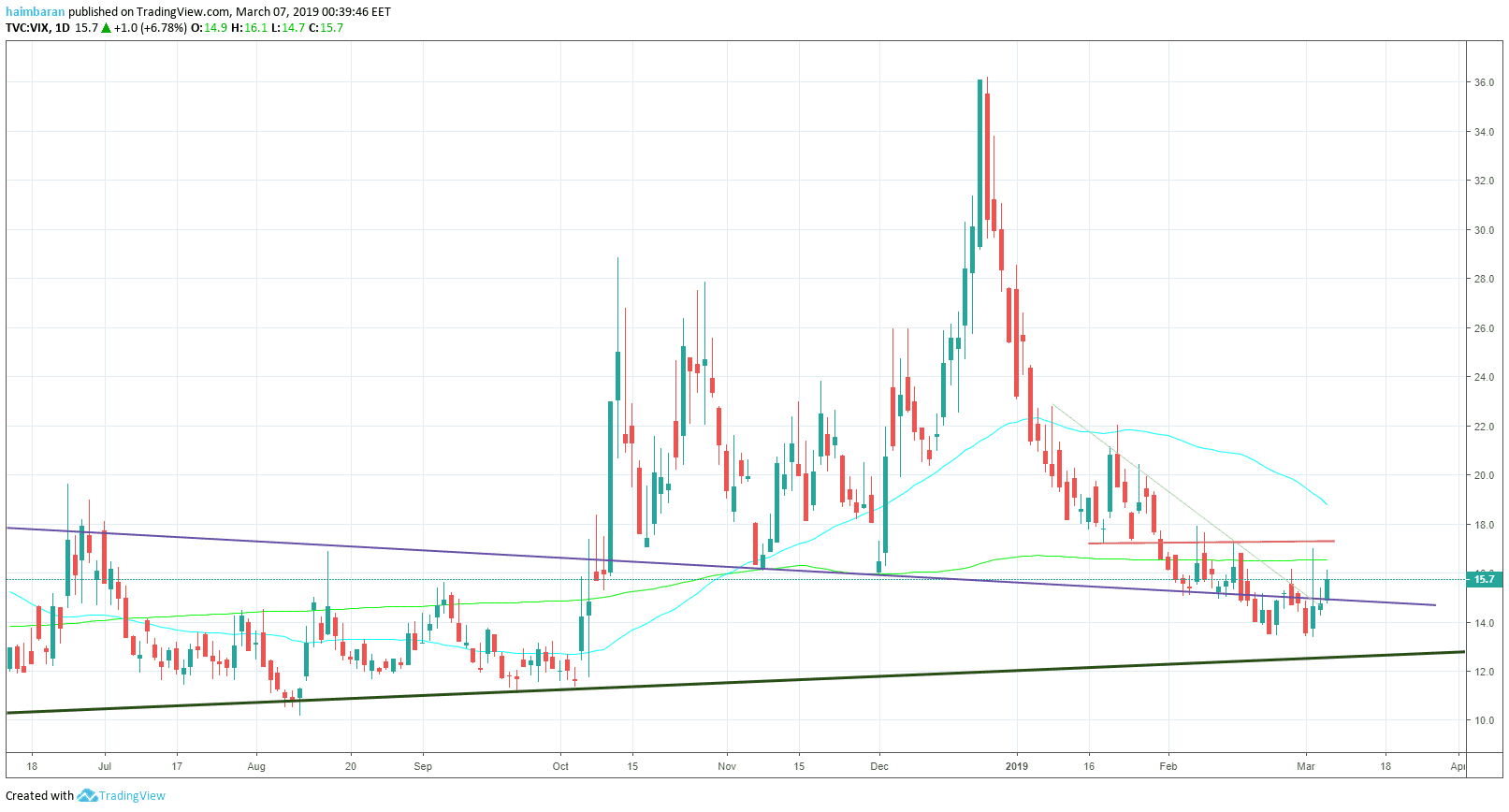

The sell-off has started; however, at this point, it’s still considered a healthy correction. The S & P over 2750 (200 days moving average line) is still considered positive. The next support lies around 2680 and 2600-2630.

The VIX +to 15.7 and shows that fear has returned to the markets, whereas the December trauma is still around.

The RUSSELL 2000 had dropped 2% today; this indicator is usually a good barometer for the market sentiment.

The silvermine gauge is approaching the zero, which is still positive but on the way -at a sharp decline.

There are no positive messages left on the way. What remains to do? Better wait patiently until things become more evident. Optimism has gone -a step and just as in soccer, if you continuously attack without scoring, you’ll get defeated. In trading, if you aim to break up, and you consistently get rejected, you will lose and drop as well.

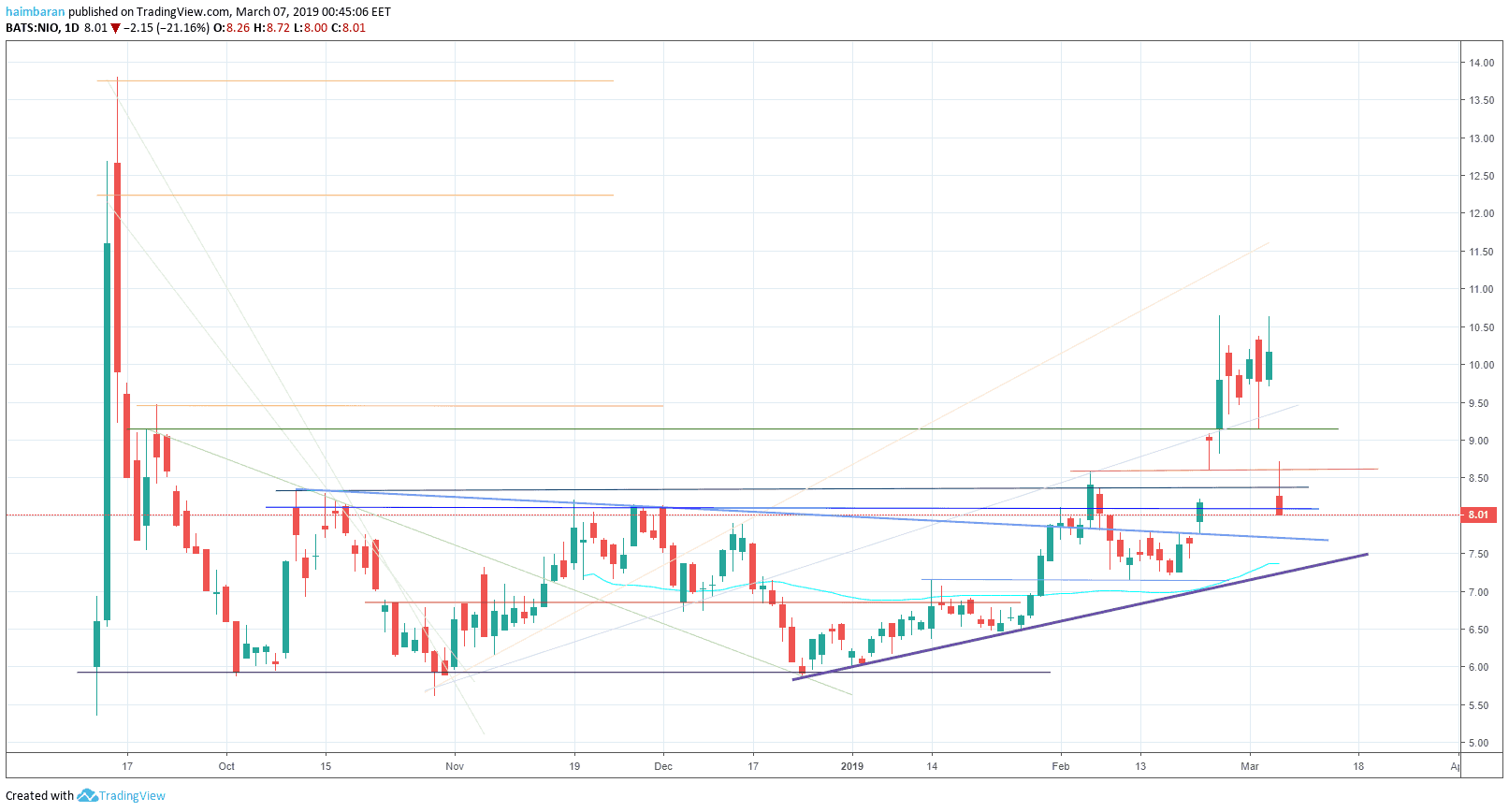

A word about NIO

Clarification about one of the recently discussed shares: NIO plunged 21% and as of now continues to drop in the pre-market to $7.73 (as of writing this), following its released reports that met the forecast (mainly by the number of car deliveries). However, the bottom line was that there was too much cash burnout and the loss was greater than expected by the investors.

More important than that is the number of car deliveries in January and February of 1800 and 800 respectively. Crash sales despite the support of the administration. Questions about what this means for the future seems to have made the rounds of the investors. Such things look strange and puzzling. It is in Chinese societies – the hidden majority on the overt.

Significant Gainers and Losers

GREEN: AFN +20.4%, ZAYO +12.6%, TSG +12.4%, AVAV +9.4%, GSKY +8.5%, LYB +6.1%, CVNA +5.5%, DLTR +5.1%, UXIN +4.8% (next week’s reports).

RED: NIO -20.85%, QTT -19.9%, LGND -11.7%, SRPT -11.1%, MRTX -9.1%, HUYA -8.8%, ASND -8.5%, NVCR -8.5%, PVTL -8%.

Charts

The post Bears In The Market – Nio Inc (NIO) Crashes 21%: Wall Street Thursday Pre-Market Summary & Analysis appeared first on CryptoPotato.