$7.5K: Bitcoin’s Price Tanks to Four-Month Low

Bitcoin’s low volatility consolidation has ended with a violent drop beyond four-month lows near $7,500.

The premier cryptocurrency fell by $500 in just 15 minutes at 12:50 UTC to hit a low of $7,500 – the lowest level since June 10, according to Bitstamp data. It is currently hovering at that price.

The global average price, as represented by CoinDesk’s Bitcoin Price Index (BPI), also hit a low of $7,549. With the price slide, BTC’s market capitalization also tanked to $135 billion.

A big move was overdue as bitcoin’s price volatility had dropped to a 6.5-month low of 2.58 percent earlier today, according to Coinmetrics.

The cryptocurrency was largely trapped in a trading range of $8,500 to $7,850 since the end of September. The consolidation was expected to end with a bullish breakout as technical charts were reporting signs of seller exhaustion near $7,850 – a key Fibonacci retracement level.

The range, however, has ended with a violent move to the downside, possibly due to massive long squeeze reported by @WhaleCalls. A long squeeze occurs when a drop in prices forces long holders to unwind their positions. That adds to the downward pressure, leading to a deeper price slide.

The range breakdown has exposed support at $7,430 (multiple daily lows in June). As of writing, BTC is changing hands at $7,600, representing a 7 percent drop on a 24-hour basis.

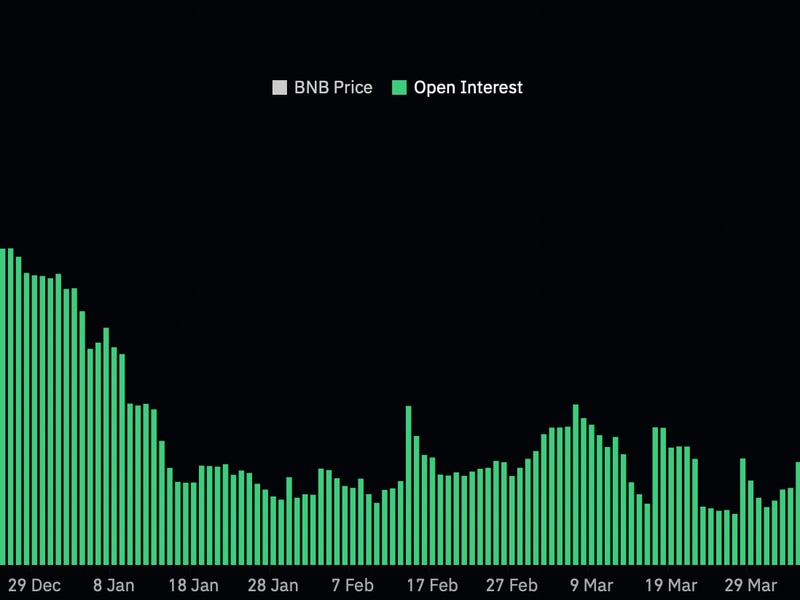

Other cryptocurrencies are also flashing red. Names like binance coin and litecoin are reporting 8 percent drop and ether, XRP and bitcoin cash are shedding 6-7 percent, according to CoinMarketCap.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Staircase image via CoinDesk archives; charts by Trading View