$500M in Shorts Liquidated as Bitcoin (BTC) Blasts Above $101K

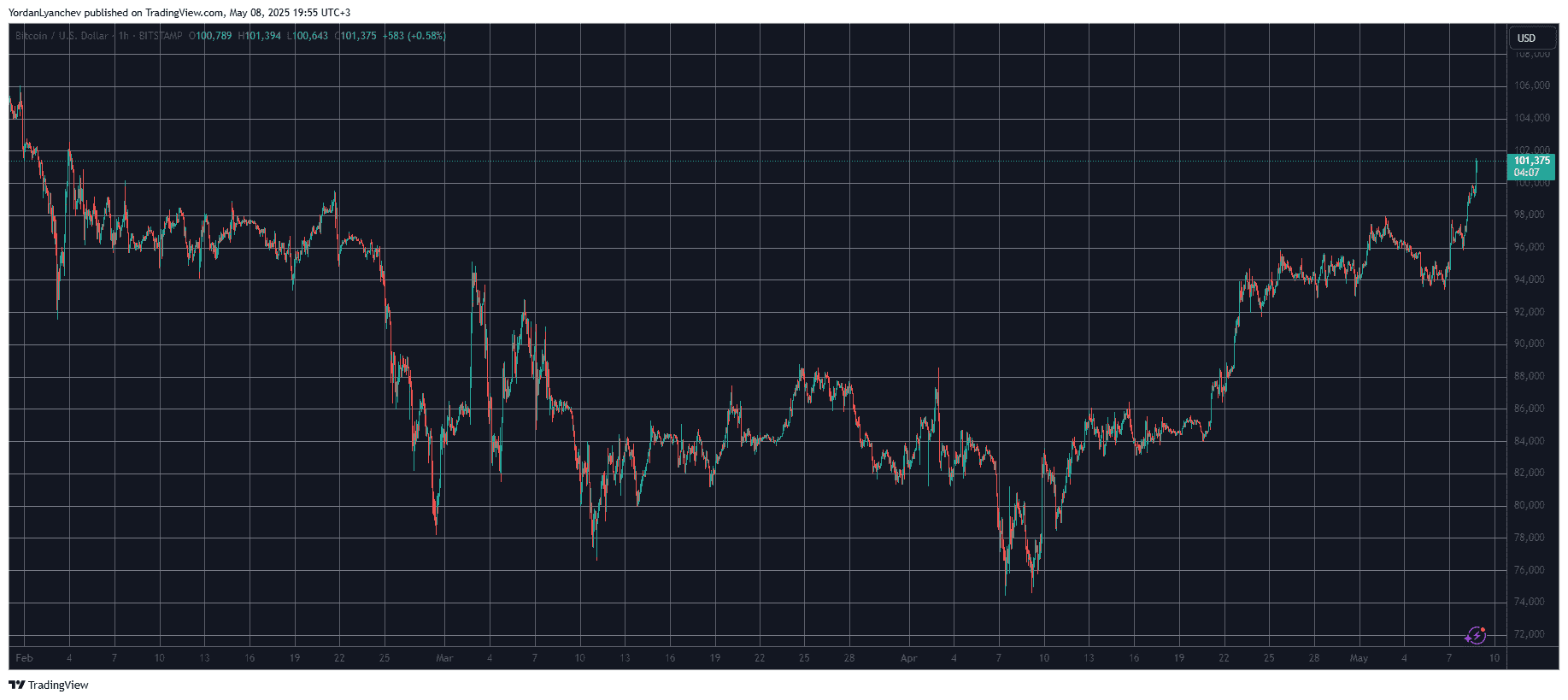

It almost felt inevitable today that bitcoin will eventually break past the coveted $100,000 milestone and after a brief hesitation, the asset has soared to a new multi-month peak above $101,000.

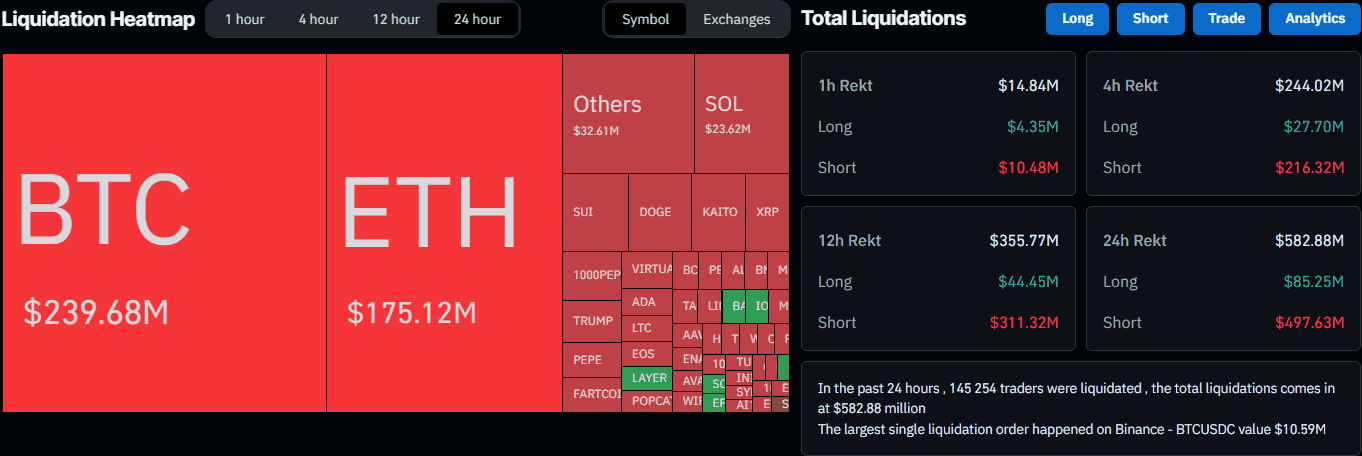

The altcoins have followed suit with massive price gains from the likes of PEPE, SUI, FARTCOIN, and many others.

CryptoPotato reported earlier today that BTC had risen to $99,700 amid reports that China and the US will have talks later this week in Switzerland in regards to striking a tariff deal. Later, Trump teased a big announcement for tomorrow that will involve the UK.

BTC stood close to the six-digit entry territory for almost the entire day and was stopped there at first. However, the asset flew past it an hour ago and kept surging to a new three-month peak of over $101,000.

Recall that just a month ago the primary cryptocurrency struggled below $80,000 and even dumped to a 2025 low of under $75,000 amid the darkest hours of the Trade War.

Now, though, bitcoin’s realized cap has marked another all-time high, while the break above $100,000 could be different than previous such increases.

VIRTUAL and PENGU lead the daily gains from the top 100 alts, with price surges of 36% and 33%, respectively. PEPE, SUI, and FARTCOIN follow suit by charting 20-25% daily jumps.

Even Ethereum has soared by double digits in the past 24 hours, and managed to break past $2,000 for the first time in well over a month.

The total value of liquidations on a daily scale is up to $580 million, according to CoinGlass. The majority, expectedly, comes from short positions (almost $500 million). The total number of wrecked trades is above 145,000.

The post $500M in Shorts Liquidated as Bitcoin (BTC) Blasts Above $101K appeared first on CryptoPotato.