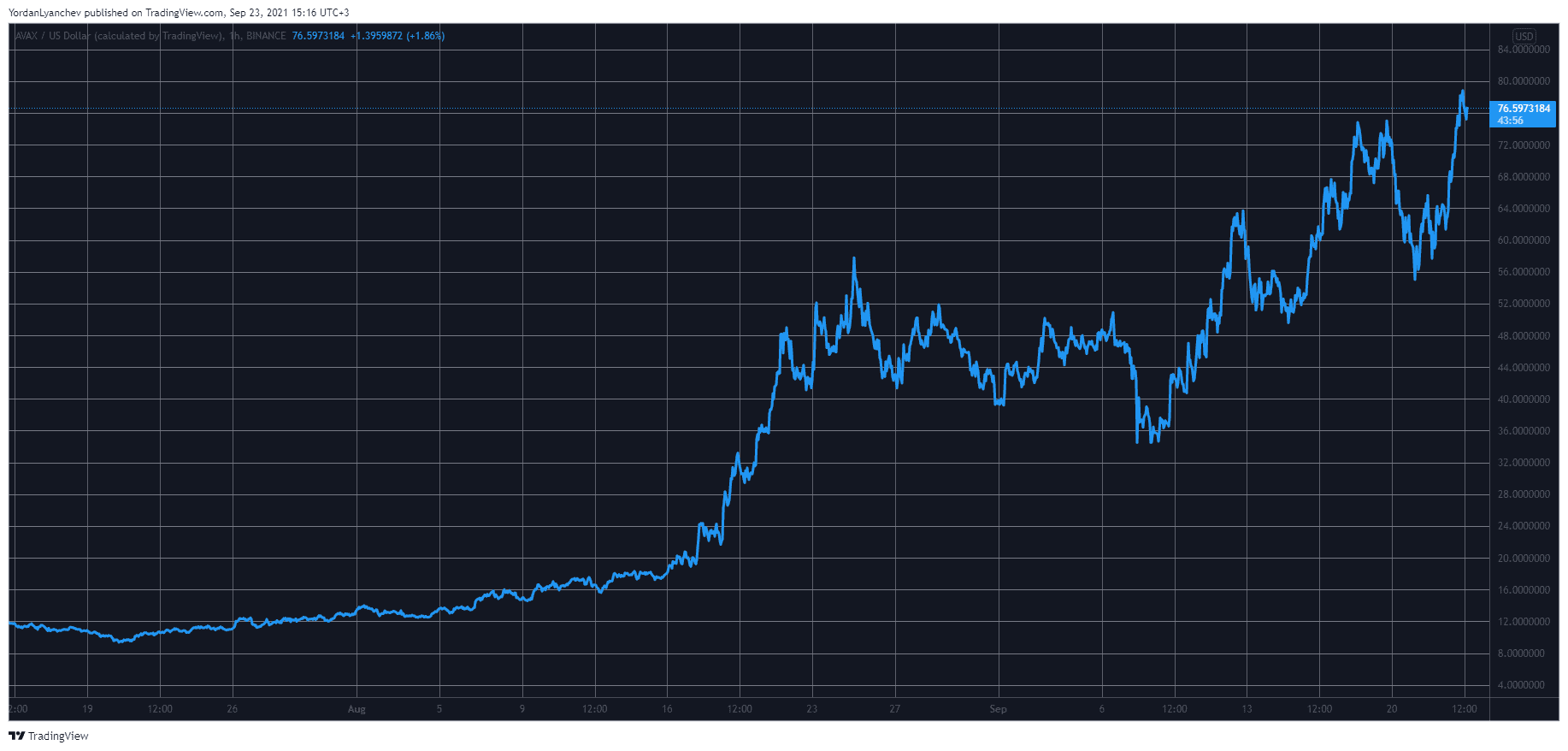

3 Reasons Why Avalanche (AVAX) is Up by 800% in Two Months

A lot can change in the cryptocurrency markets in two months. Avalanche and its native cryptocurrency – AVAX – are prime examples.

The token traded around $9 during the market-wide crash on July 20th but surged by triple-digits in this timeframe to reach a new all-time high at nearly $80 earlier today. This came after numerous consecutive records last week, before the market-wide crash.

Registering such massive price increases in a relatively short time has caught the attention of the crowd, with many keeping an eye on AVAX’s performance. As such, it’s worth reviewing what has happened with the project lately that could have propelled these movements.

Partnerships

Avalanche, which saw the light of day last year, has been highly active in terms of inking partnerships with other cryptocurrency projects in the past few months. Among the most significant ones could be the popular DeFi protocol Aave.

The vote, which is already underway, aims to determine whether investors would like to see Aave’s network deployed on the Avalanche blockchain. Should it be approved, this might lead to a further increase of the TVL on Avalanche as Aave assets on Ethereum could be transferred.

Working together with BENQI, an algorithmic liquidity market protocol built on Avalanche, the two parties released a $3 million liquidity mining initiative aiming to accelerate growth in the decentralized finance space.

Alpha Finance Lab also tapped the Avalanche blockchain to launch the second version of its Homora network. This is a part of the team’s goal to release the project on other chains and layer-2 solutions.

Separately, the DeFi and CeFi aggregator OpenOcean integrated Avalanche to increase the liquidity on its network.

TVL Explosion

The Total Value Locked (TVL) on Avalanche has also enjoyed a massive uptick in the past few months, especially since the launch of the protocol’s new DeFi incentive program backed by Aave and Curve Finance – Avalanche Rush.

The initiative was announced in mid-August when the TVL was around $250 million. In the following month, though, it skyrocketed to approximately $3 billion, before the market-wide crash wiped out millions.

Jay Kurahashi-Sofue, VP of Marketing of AvaLabs – the organization behind Avalanche – commented that this substantial increase has come despite the fact that “only about $5 million in incentives has been deployed.”

The $230M Private Sale

CryptoPotato also reported another crucial development around Avalanche lately as the team disclosed a $230 million investment round. Some of the notable names that participated in the event included the cryptocurrency funds Polychain and Three Arrows Capital.

The blog post explained that the goal of the raised funds is to support and accelerate the growth of decentralized finance protocols, enterprise applications, and other networks utilizing the Avalanche blockchain.

The project will provide grants, token purchases, and other types of investments and technology support. Although the fundraising event took place in the summer, Avalanche announced it just recently, and it actually preceded the native token’s surge to the all-time high territory at $80.